Selecting a refund preference gives you the opportunity to choose where you want your refunds delivered. Oxnard College delivers your refund with BankMobile Disbursements, a technology solution, powered by BMTX, Inc. Visit this link for more information: https://disbursements.bmtx.com/refundchoices/

Disbursement Information

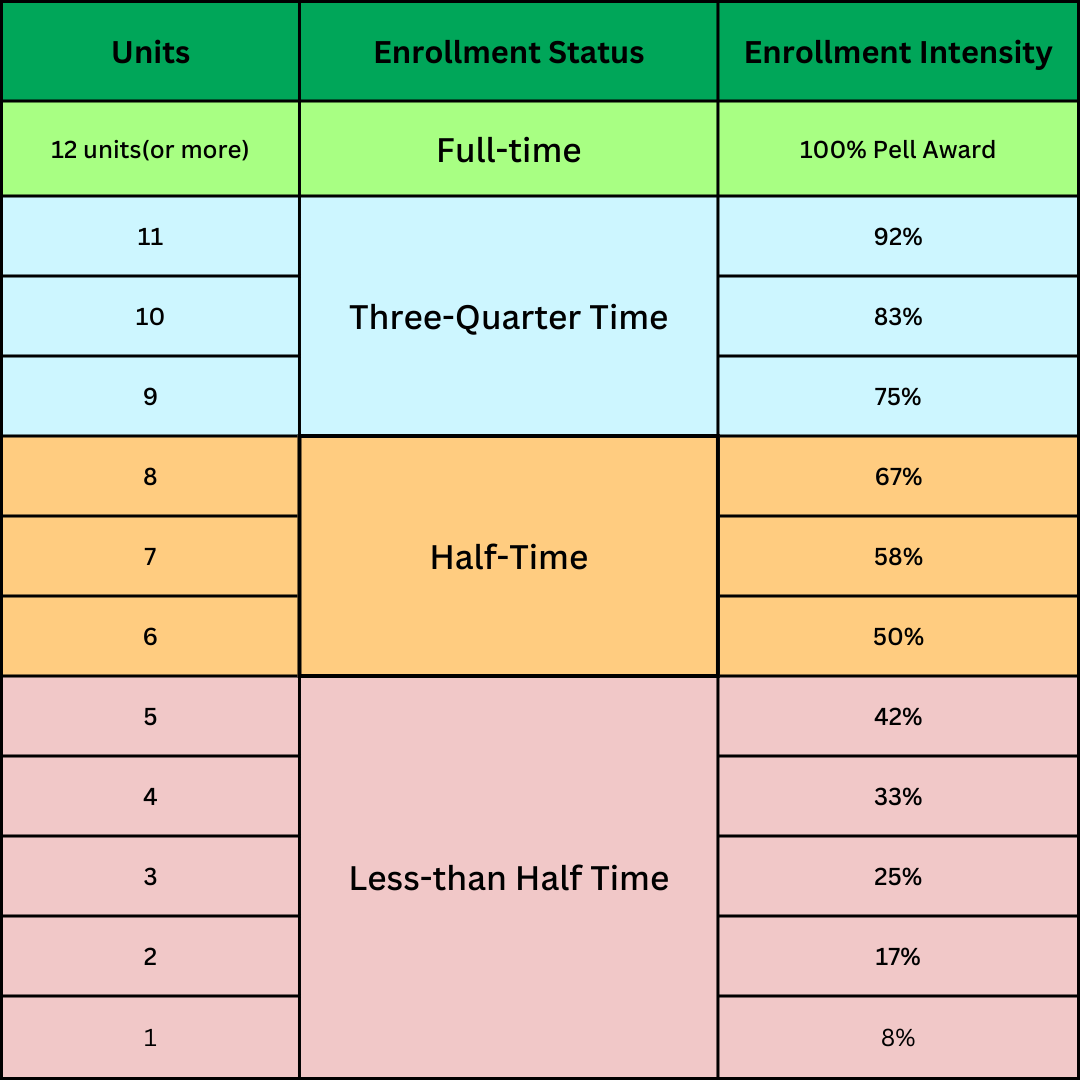

You will receive your refund 4 to 21 days after a payment appears on your MyVCCCD portal account, depending on the payment method you chose and the date your classes begin. The date noted on your MyVCCCD portal is an internal processing date ONLY. Please be aware this is NOT the disbursement date for your funds. Your payment schedule reflects a full-time enrollment assumption. If you are not enrolled full-time, the amount you will receive will be less and prorated based on your actual enrollment.

Understanding the Recalculation Date and Its Impact on Your Financial Aid

The Recalculation Date, also known as the census date or freeze date, is a critical point in the semester for students receiving financial aid, specifically Federal Pell Grants and Cal Grants. On this date, the Financial Aid Office evaluates your eligibility based on your current enrollment status, which can have significant implications for your financial aid awards.

- Fall 2025: September 2, at 12:00 pm

- Spring 2026: February 3, at 12:00 pm

Key Points to Remember

- Evaluation of Enrollment Status: The Financial Aid Office will check your enrollment status on the Recalculation Date. If your actual enrollment status does not match the status used to calculate your Pell Grant or Cal Grant, your award will be adjusted accordingly.

- Possible Adjustments to Awards: The award amounts displayed in your MyVcccd portal are not final until after the Recalculation Date. Any changes in your enrollment, such as dropping or adding classes, can result in an increase or decrease in your financial aid.

- Financial Responsibility: If you have dropped units since the start of the semester, you may have to return a portion of the grant money received. This is because your grant was initially calculated based on a higher enrollment status.

- Consequences of Overpayment: Failing to repay any overpayment of financial aid can have serious consequences. It can jeopardize your eligibility for future financial aid, making it crucial to monitor your enrollment status and ensure it aligns with the financial aid you have been awarded.

Finality of Financial Aid Awards After the Recalculation Date

- It's crucial to be aware that no revisions will be made to your financial aid awards after the Recalculation Date. This means your financial aid will be locked in and will not change, regardless of any future adjustments to your enrollment status. Your financial aid award will increase or decrease based on your enrollment status as of the following dates:

- Fall 2025: September 2, at 12:00 pm

- Spring 2026: February 3, at 12:00 pm

What This Means for You

- Finalized Awards: After these dates, your financial aid awards are final. Any changes in your enrollment status—such as adding or dropping classes after these dates—will not result in an adjustment to your financial aid.

- No Additional Grants for Late Enrollment: Any classes you add after the Recalculation Date will not be counted towards your Federal and State grant eligibility, even if those classes start later in the semester. This means that your grant amounts will be based solely on the number of units you're enrolled in as of the Recalculation Date.

- Plan Accordingly: Ensure that your enrollment status accurately reflects your academic plans by these deadlines. If you anticipate needing to adjust your schedule, it's critical to do so before the Recalculation Date to ensure your financial aid reflects your true enrollment.

Recommendations for Students

- Regularly Check Your Enrollment Status: Stay informed about your current enrollment and how it impacts your financial aid.

- Avoid Late Additions: Try to finalize your course schedule before the Recalculation Date to ensure that all your classes count towards your financial aid eligibility.

- Be Cautious with Dropping or Withdrawing: Before dropping or withdrawing from any classes, consult with the Financial Aid Office to understand how it will affect your financial aid and whether you might have to repay any funds.

- Maintain Required Enrollment Levels: Ensure you stay enrolled in enough credits, especially if you are relying on loans or state grants that require a minimum number of credits.

- Understand the Recalculation Date: Mark this date on your calendar and make sure your enrollment status is accurate before it arrives.

- Consult with the Financial Aid Office: If you're unsure how changes in your enrollment might affect your financial aid, contact the Financial Aid Office for guidance.

By understanding the significance of the Recalculation Date, you can avoid unexpected financial obligations and ensure that your financial aid accurately reflects your academic enrollment.

Your financial aid award is the maximum amount of aid you can receive in the school year. (This assumes you are enrolled as a full-time student the whole year. If you are not enrolled full time, the amount you will receive will be less and prorated based on your actual enrollment.)

See Attending Hours below:

Be aware that registration in short-term or late-start classes affects the number of units you are enrolled in and attending at any given time, which will reduce the amount of financial aid awarded and disbursed and/or veterans’ benefits you receive, or restrict your ability to play intercollegiate sports. In some cases, units for a late-start class may not be counted until the class begins; in others, the units may not be counted until after the class ends.

Consider, too, that if you register in modular classes where the first class is a prerequisite to the second – like accelerated math and English classes – and fail the first class, you are going to be dropped from the second class and will lose those units. If you have already received financial aid or veterans’ benefits, you could be required to pay back all or part of your award.

Please consider the potential impact of short term classes before deciding if they are right for you! We strongly recommend that students, who are receiving financial aid and/or veterans’ benefits, or who plan to play intercollegiate sports, talk to your Counselor, contact the Financial Aid Office or Veterans’ Benefits assistant before selecting short-term classes as part of your class schedule.

Financial Aid will be disbursed to students based on attending hours. Therefore, the start date of your classes will dictate how much you will receive in each of your disbursement(s).

If you are registered and meet all financial aid eligibility requirements for your disbursement AND:

- You are registered and ALL of your classes begin on the first day of the semester, your first disbursement is scheduled and the specific date that disbursement begins is available on your portal after all charges are paid.

- Your enrollment includes a combination of classes that start on the first day of the semester AND classes that start later in the semester, you may receive a partial first disbursement* of financial aid, if eligible, the first week of the semester. The remainder of the first disbursement will disburse approximately 14 days after your next class(es) begin.

- You are ONLY enrolled in late start classes (meaning those that start after the first day of the semester), your financial aid disbursement(s)* will occur approximately 14 days after each late start class begins.

Please Note: Students must be registered in ALL of their classes, regardless of when they begin, prior to the Freeze Date of the semester in order for those courses to count toward your financial aid enrollment status. Courses registered in after this date cannot be considered for federal financial aid funding.

All students should allow 14 days after payment appears on your MyVCCCD portal account to receive your refund.

*Loan disbursements for students in 6 or more Attending Hours (your classes have begun) will begin disbursing the second week of the semester or once you are attending 6 or more units.

- Direct Loans are issued to students in multiple disbursements. Direct Loan borrowers will be charged loan fees which are deducted from the loan proceeds and are used to cover the costs of loan defaults and other administrative costs of the Direct Loan Program. After your loan has been certified, you will receive a Loan Disclosure Statement with pertinent information regarding your loan, including disbursement dates, deducted fees, and net disbursement amounts. Disbursement dates that appear on the Direct Loan Disclosure Statement are approximate dates. Please allow two additional weeks of processing time from the date that appears on your Direct Loan Disclosure Statement.

Half-time enrollment must be maintained and verified before each loan disbursement.

If you are a first-year, first-time loan borrower, there will be a 30-day delay in your first loan disbursement.

You have the right to decline the loan or to request a lower loan amount by completing a Financial Aid Revision Form.